Affirm is a buy Today, Enjoy Later (BNPL) economic services device which allows customers to acquire products or services having full visibility sufficient reason for no invisible charges that will be associated that have traditional fund.

They verifies your identity with this recommendations and you will renders a fast financing choice

- Become 18 ages otherwise earlier (19 years or earlier in the Alabama or if perhaps you are an effective ward of your county in the Nebraska).

- Provide a legitimate You.S. or APO/FPO/DPO home address.

- Bring a legitimate U.S. mobile or VoIP matter and you will invest in located Texting texts. The device account need to be joined in your identity.

- Render your own complete name, current email address, go out out of delivery, and also the history cuatro digits of one’s public safeguards count in order to allow us to guarantee their title.

It verifies their name using this type of pointers and you can produces a simple loan decision

- On checkout, like ‘Shell out having Affirm’.

- Affirm prompts one to enter into several pieces of pointers: Identity, email address, cell phone number, go out out of delivery, and the last four digits of your personal security number. This article must be consistent and your individual.

- With the intention that you happen to be the individual making the pick, Affirm delivers a text message towards the mobile having good novel consent code.

- Go into the consent password for the form. Within a couple of seconds, Affirm notifies your of your loan amount you are recognized having, the interest rate, therefore the number of days you pay regarding your own mortgage. There is the substitute for pay back your loan more than up so you’re able to three years according to cart dimensions. Affirm states the level of your own fixed, monthly premiums as well as the complete number of desire you’ll spend more than the class of your own mortgage.

- To simply accept Affirm’s financial support offer, mouse click Confirm Loan and you are clearly done.

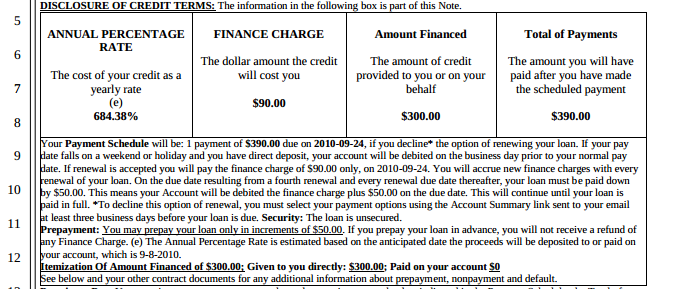

Affirm reveals any requisite charges upfront before making a buy, you know precisely what you would buy the financing. Affirm doesn’t costs people invisible charge, together with annual charge. Delight select particular facts below:

Take note that the cart thresholds try at the mercy of changes in the Affirm’s discretion, while they still improve this type of programs for people and you may our costumers. Some consumers may not be eligible for the newest 0% Annual percentage rate money, whereby they will be considering 10-30% Apr alternatively.

Affirm asks for a few bits of information that is personal: term, email address, cell phone number, big date out-of birth, and past five digits of societal security amount. It basics their mortgage decision not simply on your credit score, in addition to toward various other research affairs. As a result you happen to be capable see investment away from Affirm although don’t possess a comprehensive credit history.

Starting an enthusiastic Affirm account and you can enjoying for people who prequalify does not apply to your credit score. If you opt to purchase with Affirm, these things can impact your credit rating: and come up with a buy which have Affirm, your fee background with Affirm, how much cash borrowing you’ve put, and just how long you have had borrowing from the bank. Investing timely can help you make a confident credit history.

I’ve no details about a customer’s money denial. Affirm aims to offer all of the borrowing from the bank-worthwhile people money that have Affirm, however, neglects provide borrowing from the bank in almost any situation. Affirm  will be sending your an email with increased information regarding the decision. Regrettably Affirm’s decision was last.

will be sending your an email with increased information regarding the decision. Regrettably Affirm’s decision was last.

If Affirm has actually difficulty verifying your name, you might have to promote more information. Affirm spends modern tools to ensure your title, also verifying their target otherwise complete SSN, otherwise requesting a photo of your own ID. Affirm takes such stages in some cases so you’re able to stop ripoff and you will provide the extremely real borrowing from the bank decision they are able to.